ZHENGHAI JIANWU

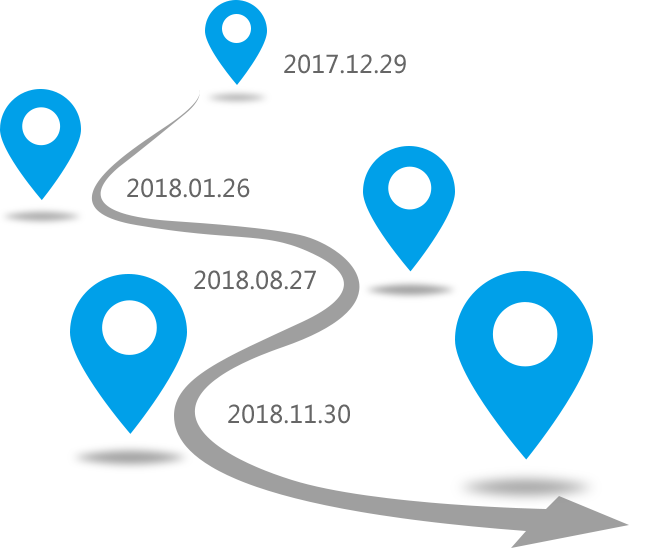

- 2017.12.29Zhenghai Janwu established

- 2018.01.26Launch of Zhenghai Jianwu special products

- 2018.08.27Registration of private security investment fund manager's qualification

- 2018.11.30Establishment of Zhenghai Jianwu private security investment fund No.1

- 2019.06.26Establishment of Zhenghai Jianwu private security investment fund No.2

Guo Yongqing, partner and chief investment officer of Zhenghai Jianwu. As a Doctor of Accountancy, Post-doctor of Industrial Economics, professor and doctoral supervisor of Shanghai National Accounting Institute and the member of the Accounting Standards Strategy Committee of the Ministry of Finance, he serves as the independent director of several listed companies.

He has been long engaged in the research and teaching of accounting standards and financial strategies, and has made in-depth researches in financial analysis, corporate valuation, management accounting, financial strategy decision-making, etc. He highlights value-oriented investment and cash flow analysis, because cash flow never lies. He conducts valuation based on free cash flow, identifies underestimation, waits for returns by the principle of safety margin and portfolio investment, and pursues absolute returns. His original valuation model of free cash flow has been proved by many listed companies.

Investment Concept

The Company highlights value-oriented investment. Since cash flow is the most authentic, it is suggested to find, purchase and hold the worthy but undervalued targets on the basis of free cash flow valuation, the principle of safety margin and portfolio investment, and the bottom-up stock selection system, wait for the value returns, and pursue sustainable and stable absolute returns.

Two revenue sourcesLook for excellent growing companies, regardless of bull/bear markets, to benefit from company growth;

Look for severely underestimated companies, buy low and sell high to benefit from market volatility.

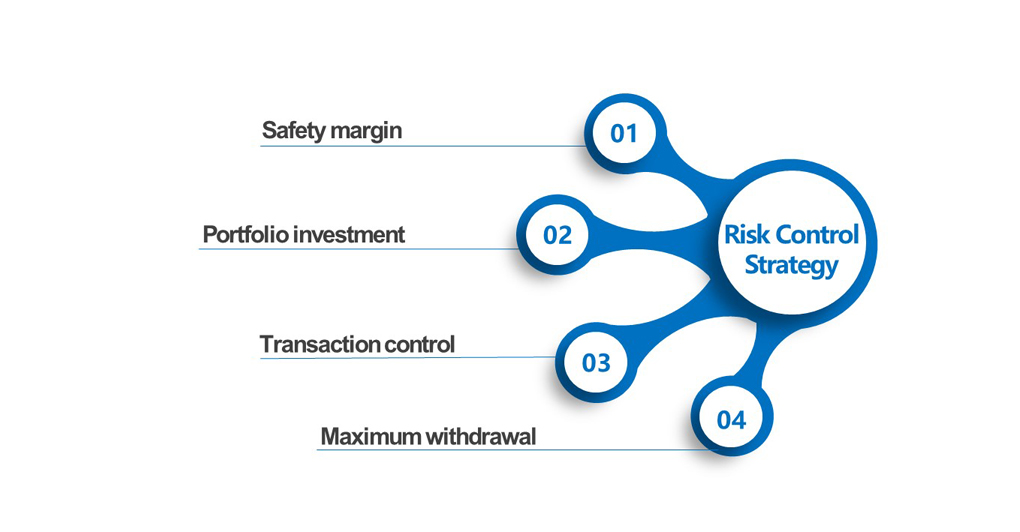

Risk Control Strategy